Like so many policy domains, international economic policy in the West has fallen victim to the Late Twentieth Century Delusion: 'People are people.'

Foreign policy was once the playground of race realists at every level. The only trace of this left may be the Pentagon, who in its double-secret PC-proofed dungeon whips up instructional pamphlets aimed at keeping GIs from getting killed by letting them know some people are, in fact, Not Like Us. (Or used to anyway.)

Back when foreign conquest was the norm, the primitive peoples of the world were seen as docile labor to exploit (rightists) or as poor backward heathen to civilize (leftists). But what no one disagreed on was that they were, in fact, primitive. That is to say, Not Like Us.

De-colonization, the U.N., etc. at last clued us in to the fact that everybody on planet earth was, in fact, just like us. International economic policy has thus taken on a rather surreal cast, as on the one hand the West insists that Africa is its equal, but on the other hand sets up trade agreements with her that make her appear, decades after de-colonization, to be a slightly retarded child.

One current example of the perils of 'People are people' is that of the European Monetary Union, or Eurozone. Conceived in the chaos of the waning days of Bretton Woods, it aimed to be something entirely new--a monetary and economic union of several large sovereign states. The hard work of Jacques Delors, among others, made it all happen.

(The British, then as now, were not enthusiasts.)

Ten years later, it all seems to be falling apart. (Don't be fooled by the lull in hysterics; disintegration continues apace.) Economists are openly warning that to survive, the Eurozone will have to split in two. Yet the 2011 EU decision-makers seemed totally baffled by the meltdown. Why?

The reasons are many; we shan't look at all but only one: People aren't people.

The Eurozone, some have surmised, was at its heart an attempt by the French to neuter fearsome Germany once and for all. The German cities and states had long been wealthy trade centers, but unification in 1871 gelled them into a power that brought Europe to its knees. Germany was, in a word, scary. Forcing her to entwine her fiscal fortunes forever with those of Mediterranean Europe... what better way to leash the giant?

So how did it happen?

As Bretton Woods broke down, several European states began to peg their currencies to each other: The European Monetary System (EMS) was born. The end goal was a single currency for all of Europe, with liberté, égalité, and fraternité for all. But there was always a niggling problem.

During this time [1983-87], the Deutsche mark evolved as the anchor currency of the system, and the anti-inflationary policies of the Bundesbank became the reference point for partner countries....

There were perceptions that the system was "asymmetric" because of the dominant role of the Deutsche mark...

In the wake of the Wall Street crash of October 1987, ...international funds sought refuge in the Deutsche mark, and strong tensions developed within the ERM [European Exchange Rate Mechanism]... (1)

What to do when the dream of equality bumps up against the reality of superiority?

While Germany may have chained herself to this shaky ship to atone for her WWII sins, for the weaker southern economies it was basically a free-cash bonanza. (Much like EU accession).

Once they had joined the euro zone, Europe's southern countries gave up trying to sort out their finances, says [ex-Finance Minister] Papantoniou. With a steady flow of easy money coming from the northern European countries, the Greek public sector began borrowing as if there were no tomorrow. This was only possible because the country, in becoming part of the euro zone, was also effectively borrowing Germany's credibility and credit rating.

Then the 2008 world credit crunch hit and the tide went out, revealing who was not wearing a bathing suit. Unpayable debts, hand-wringing, finger-pointing, late night negotiations, harried Brussels press conferences, riots, tear gas... Time to throw in the towel?

I. * COMMONWEAL-ORIENTATION *

Were the EU decision-makers to cave in and admit it's time to build a better currency union, where could they start? This anecdote may help:

Almost all of the many factories and warehouses in [northern Greece's] industrial zone of Komotini are now shut down, and yet they look as if they were brand-new.

Most of the companies there never even opened their doors for business. In fact, the abandoned buildings are the ruins of subsidy fraud. Their developers obtained funds and low-interest loans from the government in Athens and from the EU to build the factories and warehouses, but they never intended to do any business there.

...Transparency International considers Greece to be the most corrupt country in the EU. Permits and certificates can only be had in return for cash. Not everyone in Greece sees this as a problem. Some see corruption as part of Greek culture, and they also believe that taxes are unnecessary. ... the businesses that do grow and realize profits find ways to pay almost no taxes at all. Every year, the Greek state misses out on an estimated €20 billion in unpaid taxes. A third of Greece's economic activity is untaxed.

Transparency International--NGO which sends poll-takers all over the world each year to ask the Joe on the street how corrupt he thinks his country is. The not-at-all ethnically suggestive ranking that begins like this:

And ends like this:

Ethnic-Euro countries only?:

Or, to look at it another way,

The World Values Survey also publishes data on societal trust levels:

Southern Europe's far lower trust levels have been attributed among other things to their excess of 'amoral familism' (or 'altruistic nepotism'), that is an intense loyalty to one's family / clan coupled with indifference or hostility to the larger society.

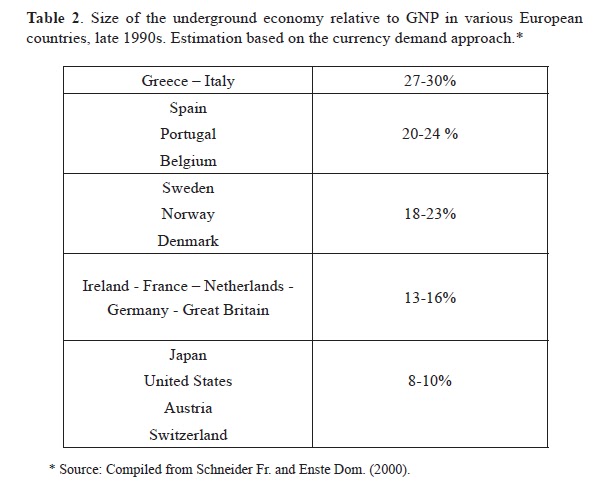

What it means for a currency union is that such a society is likely to made up of (1) shoppers who are happy to forego their receipt at the grocery (wink wink), (2) business owners who avoid paying taxes, (3) tax inspectors happy to let you off the hook in exchange for a fat envelope, and (4) elected officials happy to let anything happen in exchange for a fat envelope. Everyone, in a word, is on the take.

How can that co-exist in the same currency union with this?

[Finance Minister] Jörg Asmussen ... is a type familiar in Germany but absolutely freakish in Greece—or for that matter the United States: a keenly intelligent, highly ambitious civil servant who has no other desire but to serve his country. ... When I asked another prominent German civil servant why he hadn’t taken time out of public service to make his fortune working for some bank, the way every American civil servant who is anywhere near finance seems to want to do, his expression changed to alarm. “But I could never do this,” he said. “It would be illoyal!”

II. * FUTURE TIME ORIENTATION *

Another must-have among the members in a currency union is a similar level of future-time orientation. Those who think little of the future tend to borrow freely and save rarely. As a government, when your creditors think you can't pay back your debts, they start charging you the same interest rates you get down at the payday loan palace and it's all downhill from there (witness current EU meltdown). But how could one assess such a trait in a future currency union co-member?

From self-reported values studies such as the GLOBE study (late 1990s), or the latest international laboratory study on future orientation (Wang et al. 2011):

One could consider the monetary investment made in educating the young:

One could evaluate a country's debt-to-GDP ratio:

III. * WEALTH CREATION *

Roughly similar economies can also help a currency union run well. In their absence, an optimum currency area must have

A risk sharing system such as an automatic fiscal transfer mechanism to redistribute money to areas/sectors which have been adversely affected...This usually takes the form of taxation redistribution to less developed areas of a country/region. (Frankel and Rose, via Wiki)

GDP per capita in W. Europe, 2006 (pre-crisis):

Of course, when it comes to running a modern economy, there are quantitative indicators, and then there's good old-fashioned observation.

Albert Gehring mentioned in 1908 one notable trait of the 'Teuton':

There is a deliberation and hesitation about the actions of Germanic people which contrasts sharply with the vivaciousness, of their southern cousins. ... The persistency of the Teutons is shown in the patience and diligence of the German labourer, the tedious researches of the university professor, the dogged resistance of the English soldier, and the indomitable energy of the Yankee speculator. It may account for their marvellous success in colonisation and their mastery over the material world; for the commercial prosperity of the Dutch during the 17th century, the English supremacy of the last hundred years, and the German and American emergence of to-day. (2)

One hundred years later, and ten years into the Euro project, Der Spiegel's verdict:

In the end, only two possibilities [for the Eurozone] will remain: a transfer union, in which the strong countries pay for the weak; or a smaller monetary union, a core Europe of sorts, that would consist of only relatively comparable economies.

Financial Times is even more blunt:

That is why we need a plan “C”: Austria, Finland, Germany and the Netherlands to leave the eurozone and create a new currency leaving the euro where it is. If planned and executed carefully, it could do the trick: a lower valued euro would improve the competitiveness of the remaining countries and stimulate their growth. In contrast, exports out of the “northern” countries would be affected but they would have lower inflation.

* * *

If a price is information, then a currency is reputation. Why have both of the dominant world reserve currencies of the last hundred fifty years been issued by Anglo-Saxons? Why are seven of the eight most popular reserve currencies in the world today issued by ethnic North Europeans? Why are current bond yields for Mediterranean Eurozone members so very much higher than those for North European members?

Does a currency, like a government system, reflect the people who created it?

Any currency, like any government, can undergo a sharp shock. No country is immune to the hysteria of an investment bubble, the aftermath of a war or natural disaster, or a speculative attack.

But why, over time, do some peoples seem to issue currencies that just inspire confidence?

One final word on the Greek calamity:

[Economist Christophoris] Sardelis claims that he had recognized the looming problems and warned against them. Today, he describes a mood characterized by the ever-increasing "illusion that the monetary union could solve our problems." But instead of pushing for serious reforms of Greek government finances, the Greeks simply "relapsed into old mentalities." Instead of saving being promoted, obtaining "as much money as possible" was encouraged.

'Old mentalities' do not disappear with the flick of a eurocrat's wand. From Vanity Fair's 2011 conversation with German Finance Minister Asmussen:

He couldn’t put it more bluntly: if the Greeks and the Germans are to coexist in a currency union, the Greeks need to change who they are.

Building a better currency union means not expecting a people to change who they are. It can't be done. If Griggs and Hocknell are correct that there are over one hundred 'nations' in Europe, then there is surely much more separating Germany and Greece than Kölsch and moussaka. This patchwork of peoples is already more precarious than it may seem.

The more able and the less able have always found a way to co-exist, be it empire, slavery, tribute, 'national unification,' or neo-colonialism. The North will keep paying for the South in Italy, and in Spain, and in Belgium... But will northern Europe keep paying for her southern half?

Despite all attempts at leashing her, Germany's seeming economic superiority vexingly bubbles to the surface. One wonders what legacy it shall leave:

Before Germany's [Eurozone task force member] Horst Reichenbach had even stepped off the plane in Athens, the Greeks knew who was coming. He had already been given various unflattering nicknames in the Greek media, including "Third Reichenbach" and "Horst Wessel" -- a reference to the Nazi activist of that name who was posthumously elevated to martyr status. The members of his 30-strong team, meanwhile, had been compared to Nazi regional leaders.

The taxi drivers at the airport were on strike, while hundreds stood in front of the parliament building, chanting their slogans. One protestor was wearing a T-shirt that read: "I don't need sex. The government fucks me every day." Within the first few hours, Horst Reichenbach realized that he had landed in a disaster area.

EU policy-makers take note.

Previously:

(1) Ungerer, Horst, A Concise History of European Monetary Integration: From EPU to EMU. Westport, Quorum Books, 1997.

(2) Gehring, Albert, Racial Contrasts: Distinguishing Traits of the Graeco-Latins and Teutons. NY: G.P. Putnam's Sons, 1908.

11 comments:

It's interesting to me that the economic situations of states within the US don't really seem to mirror the attributes of their residents in the same somewhat 'predictable' fashion that they do in Europe. Mississippi, our least intelligent state, is arguably in better financial shape than Massachusetts, our most intelligent one, is. Of course, there are federal subsidies to untangle, but politics appear to matter quite a bit, too.

Maybe early EU dreamers thought that such a union would work itself out in the same way.

Maybe early EU dreamers thought that such a union would work itself out in the same way.

Not only did they, they still do now. I hear all the time how we need a 'United States of Europe' to fix this mess. What they never counted on I think was the language/culture barrier. If things look bad in Massachusetts, you can move to Mississippi with little real difficulty. But a Portuguese just up and moving to Belgium is really tough. Outside that little MBA class of English-speakers, it's not that common, the culture etc. is just too different.

Also the 'bail-out solidarity'--Detroit, which is going under, looks to Michigan to save its bacon, and MI taxpayers aren't thrilled but they'll pony up. Ditto a state, California's been flirting with bankruptcy but if push came to shove US taxpayers would suck it up (look how little we resisted bailing out our rootless internationalist banking class). I don't think anything near that level of solidarity exists between euro member states, esp. not Germanic and Latin ones. For the average German, the profligate Greek can starve for all he cares, and if Merkel won't make it happen he'll vote in someone who will.

Which is the unsolvable problem of the Eurozone--nobody is in charge. If Michigan unilaterally decides to stop sending its federal taxes to D.C., national troops could march right in and take them. If Greece unilaterally reneges on every treaty obligation it's made to the EU, what happens? A bunch of eurocrats fly in to give them a stern scolding then fly out again. The Greeks are laughing. At some point this headless body's going to wander off a cliff.

Bonjour M.G. :

On this post: Wow. Masterly. Is this the development of a whole new discipline, HBD-aware Economics?

The question is, is there a money-making future - realistically - in doing HBD-aware financial consulting?

Your posts are getting more scholarly and engaging, heartfelt congrats from the Paris Boum Boum of the faschosphère,

Bien à vous,

- Artur

ps: Have you seen these guys ? :

galliawatch.blogspot.com/

Thanks. I'm pretty ignorant about the workings of the EU. What are, generally speaking, the consequences for violating EU policies and agreements? Nothing more than just that, some Brussel bureaucrats solemnly shaking their heads and expressing their "deep concern"? Potentially being kicked out of the union, which is probably a pretty hollow threat, especially if it's one of the big, net productive players like Germany doing the violating?

The corruption graph you reproduce is remarkably-stark. Shown are 17 European nations, the USA, and Canada.

There are three clear 'tiers' in this data set, that is, three clean breaks in the data.

Top Tier (least corrupt): (Finland, Denmark, Sweden, Canada, Netherlands, Luxembourg, Norway, Switzerland, UK). Eight are Germanic states. One is heavily-Germanic-influenced Finland.

Second Tier (middle): Austria, USA, Ireland, Germany, Spain, France, Belgium, Portugal. Within this middle-tier group, Germanic and heavily-Germanic nations still have the edge.

Bottom Tier (most corrupt): Greece, Italy. South-Mediterranean states with reputations for shiftlessness, laziness, inefficiency. [Greece is so corrupt, it may even deserve a 'fourth tier' of its own].

Only those who are blind would not be able to see a pattern.

(Note that if this data is based on self-reporting, it's possible that Germany's and Austria's scores are artifically-depressed by ongoing post-1945 cultural pessimism, even if just by a point in total, otherwise making them tier-one states).

M.G., given your familiarity with France, I hope we see commentary soon on the election, particularly addressing this difficult question.

Audacious Epigone--

What are, generally speaking, the consequences for violating EU policies and agreements?

For the Eurozone, they're laughably weak. To wit:

How does the Stability and Growth Pact work?

The original SGP said that all countries in the Eurozone should aim to keep their annual budget deficit below 3% of GDP, and keep total public debt below 60% of GDP. If a country broke the rules, it had to take measures to reduce its deficit. If it broke the rules in three consecutive years, the Commission could impose a fine of up to 0.5% of GDP.

Yes, an insolvable country whose citizens are sleeping in the streets, begging NGOs for health care, and committing suicide in public over slashed pensions no doubt has .5% of its GDP just sitting around to send over to Brussels. Not too well thought-out that one.

But the rules were moot from the get-go, because the big boys broke them first:

Once the Euro was launched, many countries had difficulty meeting the SGP rules. In 2003, the largest economies in the eurozone, France and Germany, broke the rules [their budget deficits exceeded 3%]. However, because these countries promised to reach the SGP targets as soon as possible, the Commission did not take strong action against them.

Promises, promises...Then it came out that Greece lied about its budget numbers to get in in the first place. Now what do you do? The whole Greek government is corrupt--who watches the watchers? This is why you have have Merkel calling for 'permanent supervision' of Greece and the Greeks calling the Germans 'Nazi occupiers', etc. Just a mess. It's a little like the Articles of Confederation--the whole thing's either going to to give itself a stronger executive, or break up.

Hail--

There are three clear 'tiers' in this data set, that is, three clean breaks in the data.

Looked at ethnically, it's hard to deny. I know national IQ gets a lot of attention these days, as it should, but I myself am far more interested in character traits. (Or 'cultural values' if you will.) Those old race scientists were great for that, that Gehring quote is only one example but his whole book ('Graeco-Latins and Teutons') is just bliss. It really shows you how barren our anthropological education is today--Economics PhDs confidently asserting that if only Greece would mimic Germany's tax and labor laws, why, you'd have a little Germany on the Aegean! I think future generations will look back on us as deeply indoctrinated.

I hope we see commentary soon on the election

Those Majority Rights commenters said it well, esp. this: 'Basically the days of mass immigration into France are over - it will never happen again'. You can't call a political party 'extreme' anything if one in five people vote for it. Period. Marine Le Pen's FN has de-tabooed ethnic nationalism and I can only applaud them for it.

This:

How many of these [votes] were likely cast by persons of Non-European ancestry?

is in fact a question I've been looking into recently. It's illegal for the government to ask for racial origins on the census in France, so this is devilishly hard to get to the bottom of. I've got some decent French-language sources that give estimates for different regions, though. I'm going to round them up and maybe do a post on it after the final electoral round in two weeks.

Quote:

" Once they had joined the euro zone, Europe's southern countries gave up trying to sort out their finances, says [ex-Finance Minister] Papantoniou. With a steady flow of easy money coming from the northern European countries, the Greek public sector began borrowing as if there were no tomorrow. This was only possible because the country, in becoming part of the euro zone, was also effectively borrowing Germany's credibility and credit rating. "

Who was doing the lending? For every irresponsible borrower, there has to be an equally irresponsible or greedy lender. Why should the lenders be insured by the taxpayers against the possibility of any losses?

To whom is all this debt owed? I'd like to see a real listing of who is collecting what.

To whom is all this debt owed? I'd like to see a real listing of who is collecting what.

Here is a chart showing the countries most exposed to Greek debt (public and private institutions).

There's also a Telegraph article, The Big Fat Greek Sell-off, which lists some assets Greece is selling off and to which creditors:

Already advisers have been appointed to around 15 privatisation programmes, with the OTE telecoms stake earmarked as first to be sold.

The advisers and sell-offs being set up include:

• Deutsche Bank and National Bank of Greece on the sale of OPAP, the state gambling monopoly

• Credit Suisse on state lotteries

• Rothschild and Barclays appointed for road concessions

• PriceWaterhouse selected for railway firm OSE

• France's BNP Paribas and Greece's National Bank on the extension of an operating lease on Athens International Airport.

• Lazard on exploiting the commercial activities of the Greek trusts and loans funds.

The whole debacle is a master class in moral hazard. 'You shouldn't have borrowed from me!' 'Well, you shouldn't have lent to me!' (But the taxpayers will pick up the bill anyway, so when can we start this merry-go-round again?)

I see it as just one more symptom of our highly feminized modern age--High-risk behavior shouldn't have any consequences, big momma government will wrap you in her bosom and save you from yourself, if you promise not to do it again. (Lather, rinse, repeat.)

Just received a check for over $500.

Sometimes people don't believe me when I tell them about how much you can earn by taking paid surveys online...

So I show them a video of myself getting paid over $500 for filling paid surveys.

Post a Comment