We are offline due to a much-needed research

period this winter, so we've decided to re-publish some earlier pieces that you

might have missed the first time.

With 'reparations for red-lining' back in the

news thanks to the plucky Alexandria Ocasio-Cortez, here is the data we were

able to find on this thorny question back when Ta-Nehisi Coates last tossed it in the punch bowl. We hope you find it as interesting as we did.

* * *

[Re-post, original post here.]

'Ingenious and powerful,' 'important and compelling', 'stunningly ambitious;' it has 'broken traffic records and vanished from newsstands,' 'setting ablaze' social media. What is it?

It is 'The Case for Reparations,' Atlantic's June 2014 cover story by editor Ta-Nehisi Coates.

The idea has been tossed around since Emancipation, falling out of fashion as of late. Coates brings it roaring back in this long-form piece, calling on Euro-Americans to 1) publicly express their guilt about past oppression, and 2) pay reparation money to their Afro countrymen. Does his argument hold water?

The 17-page article covers much ground, but it seems Coates seeks redress for three major wrongs:

- Slavery

- Land theft

- Red-lining

They are three quite different topics, and should be treated as such. We shall begin by addressing the most recent: so-called 'redlining.'

Coates tells the story of Clyde Ross, son of Mississipi sharecroppers who came to Chicago in the Great Migration:

'Three months after Clyde Ross moved into his house, the boiler blew out. This would normally be a homeowner’s responsibility, but in fact, Ross was not really a homeowner. His payments were made to the seller, not the bank. And Ross had not signed a normal mortgage. He’d bought “on contract”: a predatory agreement that combined all the responsibilities of homeownership with all the disadvantages of renting—while offering the benefits of neither.

Ross had bought his house for $27,500. The seller, not the previous homeowner but a new kind of middleman, had bought it for only $12,000 six months before selling it to Ross. In a contract sale, the seller kept the deed until the contract was paid in full—and, unlike with a normal mortgage, Ross would acquire no equity in the meantime.'

Why was Ross obliged to buy a house 'on contract'? Because he could secure no regular mortgage financing. Chances are, in large part because he was Afro-American.

I. Neighborhood redlining

1) Neighborhood redlining--where Coates is right

Most current discussion of the practice focuses only on its racial aspect. But what is it really?

For those who think the 10% down, thirty-year home mortgage was always our birthight, think again. Before the 1930s, the typical 'balloon mortgage' required up to 50% down and had to be paid off in 5 to 10 years. After the Depression gutted the real estate market, FDR created the Federal Housing Administration to coax banks into issuing the kind of mortgages we know and love today. Suddenly Joe Welder and Jane Nurse were kings of their castle and, more importantly for Uncle Sam, construction swung into full boom, putting thousands back to work.

1930s ad touting the new FHA-backed mortgage

How to lure banks into issuing these newfangled mortgages? By promising that if one went sour, the FHA--read, the taxpayers--would foot the bill. This was uncharted territory. To avoid fiscal disaster, the FHA set lending criteria so strict that foreclosure would be all but impossible. How strict?

They gauged two things:

- The creditworthiness of the borrower

- The likelihood that the house's property value would stay steady / go up

The first was highly individual, and there were of course persons of all races who were both very good and very bad credit risks.

The second, however, is where Ta-Nehisi Coates and co. take umbrage. For it was not just you that was judged, but the neighborhood in which you wanted to buy a house. Here is where things get exceedingly sticky:

This added another critical element to the conservative stance the FHA had to adopt—namely, the property had to retain or increase its value throughout the entire term of the mortgage. To assure that this was accomplished, the Agency created a set of fully articulated and elaborated standards covering all feasible elements of housing development and home construction. (1)

In its (some say outrageous) excess of caution, FHA discouraged offering mortgages on homes found in zones 'Yellow (C)' and 'Red (D)' on its city maps, judging that property values there were surely 'on the decline,' and thus that there was a high risk Uncle Sam would end up footing the bill.

So what were these mysterious 'Yellow (C)' and 'Red (D)' zones? The FHA in 1937 explains:

"Green areas [A] are "hot spots"; they are not yet fully built up. In nearly all instances they are the new well-planned sections of the city, and almost synonymous with the areas where good mortgage lenders with available funds are willing to make their maximum loans to be amortized over a 10-15-year period ... They are homogeneous; in demand as residential locations in "good time" or "bad;..."

"Blue areas [B], as a rule, are completely developed. They are like a 1935 automobile: still good, but not what the people are buying today who can afford a new one. They are the neighborhoods where good mortgage lenders will have a tendency to hold loan commitments 10-15% under the limit."

Manhattan FHA map, 1938 (rotated)

"Yellow areas [C] are characterized by age, obsolescence, and change of style; expiring restrictions or lack of them; infiltration of a lower grade population; ... inadequate transportation, insufficient utilities, perhaps heavy tax burdens, poor maintenance of homes, etc. "Jerry" built areas are included, as well as neighborhoods lacking homogeneity. Generally, these areas have reached the transition period. Good mortgage lenders are more conservative in the Yellow areas... "

"Red areas [D] ... are characterized by detrimental influences in a pronounced degree, undesirable population or infiltration of it. Low percentage of home ownership, very poor maintenance and often vandalism prevail. Unstable incomes of the people and difficult collections are usually prevalent.... Some mortgage lenders may refuse to make loans in these neighborhoods and others will lend only on a conservative basis."

And how did the FHA decide who was 'declining' or 'hazardous'?

The fundamental requirements of FHA’s underwriting were extraordinary. These manuals were composed of nearly 2000 sections covering all feasible aspects of housing development and construction... standards on sub-soil, soil, and landscaping, foundations, walls, number of rooms, number and dimensions of bedrooms, bathrooms, kitchens, living and dining rooms, ... windows, dimensions of windows, and indeed the requirement to have a picture window on a particular wall. Also mandated were the requirements of the plumbing and sewer discharge, central heating, and the electrical system... (1)...Phew.

Each FHA map was accompanied by detailed descriptions of neighborhhoods in each zone. Some of the original 1930s documents are available online: Ohio cities, Hartford, CT, and a handful for Los Angeles. To lay to rest any doubt about the hazard Blacks were considered to property values, here is the original 1939 description of a 'red zone' Pasadena neighborhood by its FHA appraisers:

James Greer:

...Clearly, for some of the city’s residents, all neighborhoods in which they reside are in areas that the HOLC graded as very poor risk. This is the case for all African-American neighborhoods. [...] For all ethnic or racial groups other than blacks, some neighborhoods are graded very poorly while others receive high or very high mortgage risk grades. (1)

At first glance, it seems this FHA policy sharply reduced Afro-Americans' ability to buy a home:

Between 1934 and 1954, minorities accounted for less than 1 percent of the FHA’s mortgage insurance nationally [while 10% of the U.S. population]. As late as 1950, the FHA or the VA had insured mortgages on twelve thousand white, owner-occupied single-family homes nationally, but only 367 mortgages for black-occupied, single-family homes. (8)

Coates is correct, then, that the FHA considered Blacks more dangerous to property values than any other group. But there is quite a bit more to the story.

2) Neighborhood redlining--what Coates leaves out

Coates has presented one picture of redlining: That is was enforced by the FHA since the 1930s, that it kept Afros stuck in crumbling inner cities and excluded them from the mortgage market and thus from amassing wealth. How true is it?

a) Redlining largely pre-dated the FHA:

Even before the Depression, private lenders chose to avoid certain areas, particularly those home to African Americans, certain ethnic groups including new immigrants, and with older, cheaper housing. There is no evidence that they used red lines on maps to mark off these areas, but they were practicing redlining.

During the 1930s, real estate agents, appraisers, and lenders all became obsessed with neighborhood risk ratings. [...] The longterm self-amortizing loans that HOLC (fifteen-year) and FHA (thirty-year) instituted made lenders much more eager to consider the long-term prospect of their investments. (2)

But the negative impact of central city residence cannot be attributed to FHA-VA policies per se because a similar negative impact existed prior to 1940, that is well before the federal government began to intervene in housing markets. (3)

Those who put together the redlining maps were simply real estate professionals codifying what was already widely practiced:

... From 1935 to 1940, HOLC [Home Owner Loan Corporation, pre-FHA New Deal entity] appraisers sought the input and assistance from local real estate developers and realtors as well as officials in banking and the local S&L industry and prominent local officials. [...] 5,000 private real estate agents and bankers were involved in the development of these maps. (1)

b) Afro population was only one 'risk factor' among many

James Greer looked at the demographics of 'red zone' neighborhoods in 62 cities. He found a variety of factors pushed the risk up or down, with '% Black' near the middle of the pack:

c) Most people living in 'red zones' were and are Whites:

Redlining is not co-terminus even loosely with the boundaries of the existing non-white ghettos in American cities [in 1937] ... Indeed, most striking is the fact that not only are those communities which are redlined overwhelmingly populated by whites, even decades later, most of the population in these redlined areas were predominantly white. (1)

d) The FHA's biggest bias wasn't anti-black but anti-downtown:

The suburban bias of the FHA was extraordinary. For example, 91% of the homes insured by the agency in metropolitan St. Louis between 1935 and 1939 were in the suburbs. This practice would continue into the 60s and even the 70s. (5)

It is clear, looking at the original FHA maps, that their biggest bias was in fact anti-central city. New construction = safe, older homes = hazardous:

We must remember that in the 1930s, many older downtown buildings were still quite primitive: No electricity or gas hook-ups, no central plumbing or heating, little aeration... The FHA demanded totally modern amenities on any home it insured, leaving many in these older areas--both white and black--in the dust.

e) Most home loans were not and are not FHA-insured:

From 1938 to 1962, the FHA insured the mortgages on nearly one third of all new housing in the United States. ...[This number] has remained well below 20 percent since 1980. In fact, by 1997, outstanding FHA mortgages amounted to just 12 percent of the volume of conventional mortgages.

f) Black home ownership shot up during the redlining era:

Contrary to popular narrative, the FHA era did not see a dip but a massive upswing in Afro-American home ownership:

...Several pieces of evidence suggest that the indictment of these [FHA] policies may be somewhat overblown. [...] Whatever the role of redlining, the census data on mortgages clearly demonstrate that the percentage of black homeowners who held mortgages was vastly higher after 1940 than before; that is, even if black households lacked access to FHA-insured loans, they must have had access to other types of mortgage finance. (3)

This Black-White gap, as we can see, not only existed before the FHA was born, but has continued since redlining was officially outlawed--indeed long after the launch of massive minority homeowner outreach:

During the FHA heyday, just as before it and after it, mortgage lending was happening anywhere there was money to be made. In Philadelphia:

...analysis of mortgage lending in Philadelphia for the decade after HOLC [FHA entity] made its maps [1938-1950] shows that lenders did not categorically refuse to make loans to areas colored red by HOLC or provide loans with considerably different terms. Together, these findings cast doubt on the argument that HOLC caused redlining, ... (2)

The study finds that of all the vast red zones in Philly, only very small subsections were likely 'redlined':

So where did home funding for Blacks come from? Besides the 'contract selling' mentioned above, there was also the classic pre-Depression B&L (building and loan, or 'thrift'):

By 1930, seventy-three minority-owned thrifts with combined assets of more than $6.5 million were in operation across the country, and every major city with a sizable African American population had at least one such association. Philadelphia, where the thrift industry began and which was known as the "City of Homes," laid claim to nearly half of all minority-owned thrifts. (4)

During the 'redlining era,' then, we see that millions of Blacks were able to purchase homes--that in fact Black homeownership reached then-record levels. Nonetheless, Coates is right that Afros were labelled an 'unharmonious racial group' by the FHA, surely stymying their efforts to obtain property. Why was this so?

3) Neighborhood redlining--why do black neighbors bring down property values?

White Detroiters protest new federal housing project, 1942

What Coates glosses over in his piece, then, is the why of housing segregation. He seems to believe that Euros shunned Afro neighbors out of sheer malevolence, or perhaps an irrational fear of melanin. Is it the truth?

We addressed this question in detail last year in Whence Housing Segregation?, to which we kindly point readers unfamiliar with the subject. Here we shall sum up the essential:

Coates quotes a white homeowner in Levittown, PA, who says of his new black neighbor, David Myers, “[he's] probably a nice guy, but every time I look at him I see $2,000 drop off the value of my house.” Confirmation from a 1919 Chicago race commission report:

No single factor has complicated the relations of Negroes and whites in Chicago more than the widespread feeling of white people that the presence of Negroes in a neighborhood is a cause of serious depreciation of property.

[...] A leading real estate dealer said that "when a Negro moves into a block the value of the properties on both sides of the street is depreciated all the way from $100,000 to $500,000 [$1,300,000 to $6,500,000 today], depending upon the value of the property in the block"; that it was a fact and that there was no escaping it. (10)

The same was true across the country at the time, and is still true today:

But why? There were four main reasons, and readers today may be surprised to learn that little has changed in a hundred years:

a) Neighborhood upkeep

Camden, New Jersey

Yesterday:

The exclusive occupancy [in Chicago] of a block by Negroes is usually followed by less care of streets and alleys. [...] From the office manager of a South Side real estate firm: Much depreciation, he said, can be attributed to Negro tenants; they are much harder on houses than white tenants of the same station in life; they do not take proper care of the furnaces or plumbing, and the higher rents paid by them merely cover the cost of the additional repairs;... (10)Today:

White residents [in 2005 Chicago] were far more likely to report disorder than black or Latino residents living in the same neighborhood -- sensitivities that might explain, they theorized, why whites are relatively scarce in many city neighborhoods. [...] As the percentage of African Americans in the neighborhood increased, the percentage of black [as well as white and Latino] residents who judged their neighborhood to be in disarray also rose.

A sense of general disorder has long followed Afros into the areas in which they live.

b) Health threats

Yesterday:

Again, the susceptibility of the Negro to disease is another very potent reason for segregation laws. The Negro's manner of living since his emancipation irregular in every way, sometimes half-starved together with their immoral habits, have so weakened the constitutions of a great part of them that they easily become victims to disease. (11)

Today:

A wide variety of diseases are currently more prevalent among Afros than Euros, and studies are beginning to show possible genetic susceptibilities, among them HIV, tuberculosis, prostate cancer, hypertension, and obesity.

'Diverse' neighborhoods have been reported to have negative health correlations for Whites:

With the exception of males ages 1–9, the fraction of the population that is black is a significant risk to mortality at all ages. It is particularly high for 15–19-year-old males, falling off for the following 15 years, but rising again rapidly thereafter. The correlation is present for all age groups of women. These results are consistent with work by Miller and Paxson (2001) that finds the fraction black is correlated with mortality among whites aged 25–64 across a wide range of diseases.

c) Lack of family values

Mother and two children on welfare, Chicago, 1941

Yesterday:

[W.E.B. DuBois, writing of Philadelphia in 1899:] The number of deserted wives, however, allowing for false reports, is astoundingly large and presents many intricate problems. A very large part of charity given to Negroes is asked for this reason. ... Here is a wide field for social regeneration.

[...] There can be no doubt but what sexual looseness is to-day the prevailing sin of the mass of the Negro population, and that its prevalence can be traced to bad home life in most cases. Children are allowed on the street night and day unattended; loose talk is often indulged in; the sin is seldom if ever denounced in the churches. (12)

[Collins:] Huffman says that in 1894 more than one-fourth of the colored births in the city of Washington were illegitimate. Many prominent Negroes admit that above ninety per cent of both sexes are unchaste. A negro may be a pillar in the church and at the same time the father of a dozen illegitimate children by as many mothers. (11)

Today:

Euro-Americans still sense that their Afro co-citizens do not share their familial values, and that this makes them poor neighbors. The latter have lower marriage rates, higher divorce rates, more unwed motherhood (formerly known as 'illegitimacy'), more child abuse, engage in more gambling, have poorer credit, their children have more school discipline problems, and they're far less likely to have two parents in the home:

Data source

d) Criminality

Yesterday:

[W.E.B. DuBois:] In the city of Philadelphia the increasing number of bold and daring crimes committed by Negroes in the last ten years [1889-1899] has focused the attention of the city on this subject. There is a widespread feeling that something is wrong with a race that is responsible for so much crime, and that strong remedies are called for. (12)The numbers bear him out:

Today:

These concerns remain current a century later:

Coates' insistence, then, that segregation policy was somehow irrational is little supported. The evidence clearly shows that from the Great Migration onward, Afros' reputation preceded them--and where it did not, Euros quickly fled what they reasonably perceived as highly undesirable neighbors.

II. Individual redlining

1) Individual redlining--the evidence

Neighborhood redlining was officially outlawed by the 1968 Fair Housing Act. But all was not well. Now, we are told, instead of refusing to lend for homes in black neighborhoods, banks are often refusing to lend to black people at all--individual redlining, or 'mortgage discrimination.'

Schafer and Ladd in a 1978 study on California and New York found that Blacks were being denied loans more than Whites, even with similar credit ratings:

In 18 of the 32 California areas and six of the ten New York areas, black applicants had significantly higher chances of loan denial than similarly situated whites. The differences were large, with black applicants being 1.58 to 7.82 times as likely to be denied as whites. (9)

A 1990 Boston Fed study found the same:

If the typical denial rate for whites was 10 percent, the typical denial rate for a comparable black applicant would be about 18 percent. Given the comprehensiveness of the set of control variables, it is hard to avoid the conclusion that the remaining differentials between whites and minorities indicate that lenders discriminate against minorities in the lending decision. (9)

These are but a few of a long list of such studies. It would seem that even with similar credit histories to Euros, Afros are turned down more often for loans. How could this be? Isn't everybody's money green?

2) Individual redlining--why are Afro-Americans considered a bad credit risk?

If Whites and Blacks with comparable credit histories really do default at the same levels, then why would lenders leave money on the table by turning Blacks down at higher rates?

In a study on 220,000 FHA-backed home loans from 1987-1989, Berkovec et. al. found a clue:

In other words, just as an 18-year-old woman and an 18-year-old man won't be charged the same for car insurance, actuaries having noticed that the latter tends to get in more accidents, a 'similar credit history' for Afros and Euros may not mean what we think it means.Indeed, black borrowers are found, all else being equal, to exhibit a higher likelihood of mortgage default than other borrowers. These findings argue against allegations of substantial levels of bias in mortgage lending. ... This finding is the opposite of the prediction of the model for lender bias against black borrowers. (6)

Data source

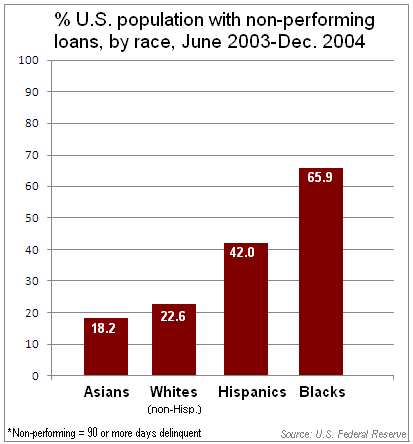

A 2008 Federal Reserve study on 300,000 credit records from 2003-2004 ('the most comprehensive examination of the relationship between race, creditworthiness and loan performance to date') found that

Blacks and Hispanics tend to perform worse on their credit obligations than white borrowers with similar credit scores. These differences are reduced, but not eliminated, when other personal demographic or neighborhood characteristics are controlled for. This result suggests that the credit scores for black and Hispanic borrowers tend to be higher than their subsequent credit performance would warrant. (7)

A reminder of global credit scores in the U.S by race (these statistics indicate to certain lenders that Afros may be less future-oriented and thus higher-risk):

Everything else the same, this result suggests that lenders might have economic incentives to discriminate by charging black borrowers higher interest rates (or having higher deny rates for black applicants) than white borrowers with comparable assessments of creditworthiness (as measured by credit scores). (7)

III. Reparations merited?

Having looked at the history of redlining, both neighborhood and individual, as well as the Afro character traits that drive it, can we agree with Mr. Coates that present-day reparations are merited?

1) Reparations for redlining--The pros

James Greer, while very critical of the prevailing narrative on redlining, admits that

...Much worse, a de jure policy of the FHA and especially odious, was the FHA’s adamant refusal to provide mortgage insurance even on newly constructed homes if these homes were available for non-white occupancy. (1)

The fact that Afro-Americans were able to secure home loans--through predadory 'contract selling' or classic black building and loans or elsewhere--doesn't change the fact that the FHA severely limited their options, more so perhaps than what was merited by their reputation as undesirable neighbors and high credit risks.

There were exceptions, but they were vanishingly rare:

The FHA, for example, funded Aiken’s building of “America’s first and only all-colored modernized home” on Atlanta’s west side in 1935. [...] FHA officials John Millsaps and Harry Burns “heartily commended” Aiken and, along with thousands of Atlantans, toured the home that April. Despite this promising start, FHA-or VA-backed black projects were rare, and each was a victory. (8)

The fact is, FHA's racially exclusionary lending guidelines may have done much to keep Blacks cloistered in inner cities, where landlords could charge exorbitant rents (knowing Blacks' options were limited), and leaving them easy prey for unscrupulous blockbusters and contract sellers who profited from their disadvantage.

2) Reparations for redlining--The cons

Chicago in red and yellow

Coates' suggestion to hand over to today's Afro-Americans, in the form of cash, the difference between current per capita black and white net worth is not reasonable. The chicken or the egg: While FHA redlining surely gave Euros a headstart on home ownership, we cannot assume the wealth difference between Whites and Blacks today is based solely or even mainly on this factor. The large homeownership gaps existed long before the FHA was born, lasted through the redlining era (1935-1968), and still continue today:

As we have seen, Afro-Americans:

- have poorer credit than other groups

- are considered undesirable neighbors, thus bringing down property values, a large reason why their homes are worth less than those of other groups

Both are factors endogenous to Afros, not imposed from the outside. In our estimation, they explain the bulk of the difference in White-Black net worth today, nearly 50 years after the end of FHA redlining. They also go a long way towards explaining Euro-Americans' traditional hesitation to live near or lend money to Afros.

Image source

What could the FHA have done differently? While they were right that Blacks moving into a neighborhood hurt property values, the FHA was in a unique position to encourage earmarking some suburban land for black-only development (like the Lexington subdivision cited above). Racially homogeneous black areas should not have been excluded a priori from 'safe lending zones.'

Not taking this initiative was, we believe, a mistake. Does it merit reparations? As a cash payout, no. Millions of Blacks did find mortgage financing, and we think the evidence shows their property values would likely have remained low relative to Whites' whether the FHA existed or not.

The way to right this historical wrong is, in our view, to

- Outlaw neighborhood redlining

- Launch a federally-led outreach to potential Afro home-buyers, encouraging them to know their rights and options.

- 1977 Community Reinvestment Act,

- 1989 Financial Institutions Reform, Recovery, and Enforcement Act,

- 1992 Federal Housing Entreprises Financial Safety and Soundness Act

...all with clauses encouraging more lending to borrowers of color. The ultimate fruit of all this 'outreach,' as we now know, was in part the 2007 Minority Mortgage Meltdown, for which the U.S. taxpayer still hasn't finished shelling out, as well as a failure to close the persistent homeownership gap or wealth gap (above).

We argue that though the FHA's policy was racially exclusionary, at the time it could not have reasonably taken another. Out of the depths of the Great Depression, where millions lost or almost lost their homes, the government was desperate to get the real estate market back on track. Part of that effort was the FHA's promise to insure home loans--but only the very 'safest bets.' Based on Whites' outright refusal to live near Blacks, at that time the 'safest bets' unfortunately did not include homes in Afro neighborhoods. Our only reproach is that the FHA did not encourage the development of black-only suburbs.

* * *

Coates claims that the redlining story is a tragic one, and he is right. Blacks had to live with endless indignities, constantly reminded of their status as second-class citizens. The unpleasant reality Coates is apparently not equipped to see is that millennia of natural selection have led Afros and Euros down vastly different paths. Lower future orientation; higher impulsivity; lower cooperativeness, conscientiousness, and organizing ability are but some of the character traits that have led Euros to deem Afros undesirable neighbors and high credit risks.

This is the 'white supremacy' Coates rails against, and it is unfortunately baked into the genetic cake. The only real solution, of course, is to go back in time and prevent African slave ships from ever leaving those shores. As Richard Pryor said on his trip to Kenya, 'There are no niggers here.'

But that cake, too, cannot be unbaked. After the Great Migration, the American mortgage system found itself confronted with an unsolvable problem--how to manage home lending with two racial groups who could not live harmoniously side-by-side? We argue that with the information they had at the time, the FHA did almost, but not quite, as well as it could have.

The post-1968 institutional efforts to right past wrongs have been far-reaching and aggressively pro-minority. The original FHA underwriters used excessive caution, so much so that the agency stayed solvent for over seventy years. Now, after the Clinton and Bush era with its massive political pressure to lend to minorities (credit-worthy or not), this august institution is finally teetering on the edge of bankruptcy. If Coates is seeking reparations for past home-lending injustice, we think it's safe to say the trillion-plus subprime bail-out price tag has more than evened the score.

Enfin, we encourage Coates and his coterie to look beyond their limited narrative and to realize that it was not an irrational fear of melanin, but a healthy skepticism about the ability of NW Euros and Sub-Saharan Afros to co-habit peacefully that drove our forebears' extreme lending caution. If anything, the events of these past forty post-redlining years seem to have largely proved them right.

* * *

Coates' remaining two demands (reparations for land theft and slavery) shall be addressed in a later post. Stay tuned.

Previously:

REFERENCES:

(1) Greer, James. 'Race and Mortgage Redlining in the United States.' Paper presented at Western Political Science Association Meetings, Portland, 2012.

(2) Hillier, Amy. 'Redlining and the Homeowners' Loan Corporation,' Journal of Urban History, Volume 29, Issue 4, 2003.

(3) Collins, William J. and Margo, Robert A. 'Race and Home Ownership, 1900-1990,' National Bureau of Economic Research, 1999.

(4) Mason, David L.'The Role of African American Savings and Loans in Home Finance, 1880-1980,' Business History Conference, 2010.

(5) Smith, Sam. 'Making Cities Black and Poor: The Hidden Story.' The Progressive Review, Jan. 2000.

(6) Berkovec, James A. et. al. 'Mortgage Discrimination and FHA Loan Performance,' Cityscape: A Journal of Policy Development and Research, Volume 2, Number 1, Feb. 1996.

(7) Avery, Robert B. et. al. 'Credit Scores, Race, and the Life Cycle of Credit: Evidence from Credit Records,' U.S. Federal Reserve, 2008.

(8) Lands, Leeann. The Culture of Property:Race, Class, and Housing Landscapes in Atlanta, 1880-1950, Athens: U. of Georgia Press, 2009.

(9) Ladd, Helen F. 'Evidence on Discrimination in Mortgage Lending,' The Journal of Economic Perspectives, Vol. 12, No. 2, Spring, 1998.

(10) Chicago Commission on Race Relations, The Negro in Chicago, Chicago: U. of Chicago Press, 1922.

(11) Collins, W.H., The Truth About Lynching and the Negro in the South, New York: Neale Publishing Co., 1918.

(12) Dubois, W. E.B. The Philadelphia Negro: A Social Study. Philadelphia: University of Pennsylvania Press, 1899.

12 comments:

Jigabooty Coates owes white colored people reparations and an apology for the rampant rate of violent crime among America negroids. Black privilege must end.

This is a pretty thorough analysis of the subject. Those of us predisposed against reparations will likely be convnced. Those predisposed in favor of reparations will not be convinced. They will likely not even read the piece, as, in their view, any objective approach to the subject is inherently “racisr”.

“For those who think the 10% down, thirty-year home mortgage was always our birthight, think again. Before the 1930s, the typical 'balloon mortgage' required up to 50% down and had to be paid off in 5 to 10 years. After the Depression gutted the real estate market, FDR created the Federal Housing Administration to coax banks into issuing the kind of mortgages we know and love today.”

Home ownership became a middle class value post-World War II. But this “coaxing” in reality came from city planners, financial institutions, and (gasp) WHITE homeowners who clamored for increased opportunities to purchase homes on “friendly” terms. Market demand played an integral role here.

“During the 1930s, real estate agents, appraisers, and lenders all became obsessed with neighborhood risk ratings.”

You mean citizens of these neighborhoods became increasingly concerned about the value of their homes as a result of the 1929 stock market crash, considering that this asset represented an investment in their future. As a result of banks now becoming more ensconced in the home mortgage business, naturally they would scrutinize who they would loan money to what people. WASP lenders at that time did not consider certain ethnic groups, like the Italians and Slavs, to be “wise” investments given their propensity for their questionable living habits. It is probably in-born.

“Afro population was only one 'risk factor' among many…those communities which are redlined overwhelmingly populated by whites.”

You mean populated by undesirable ethnic groups who were deemed a significant financial and behavioral risk. WASP-owned banks in particular were not fond of their historic neighborhoods being overrun by inferior groups, especially Eastern and Southern Europeans. While assuredly blacks were on the bottom of the rung, the Italians and Slavs were only slightly better given their propensity to “ruin nice things”.

“Black home ownership shot up during the redlining era…”

It dramatically increased because they moved into traditional “white” neighborhoods, with the European breeds moving out to newer environs. Of course banks would provide the newcomers with loans, with city approval, so the tax base would not suffer anymore than it had to...in those areas. However, when blacks wanted to move out to the newer environs as their white counterparts, they were denied, even if whites were willing to sell their house to them. Furthermore, neighborhood upkeep today primarily deals with social class, not race, specifically when it comes to slum landlords and gentrification.

https://www.irishtimes.com/opinion/ireland-s-slum-landlords-have-little-to-fear-today-as-a-century-ago-1.3286354

http://www.spiegel.de/international/germany/berlin-s-gentrification-row-locals-rage-against-rising-rents-a-784966-2.html

As far as “back in the day”, immigrant families fresh off the boat, as well as second or third generation, similar to their black brethren lived in dilapidated tenements with little to no running water, with a lack of consistent garbage collection, as well as children left unattended. In addition, the susceptibility of immigrants AND blacks to disease was a potent force in the late 1800 and early 1900’s which led to significant numbers of Eastern and Southern Europeans to be deported because of their afflictions. The notion that segregation laws for blacks is justified due to their apparent ill-health is a red herring. And the correlation between “diverse neighborhoods” and negative health for whites, based on a single study, was admittedly weak by the authors, who stressed that a person’s individual health may play a more prominent role.

Coleman Hughes, a young black student at Columbia, penned this article regarding black/white wealth ineguality in Quillette. Worth a read.

https://quillette.com/2018/07/19/black-american-culture-and-the-racial-wealth-gap/

I’m going to recommend this web site!

What’s up, just wanted to mention, I liked

this post.

It was practical. Keep on posting!

i would like to bookmark the page so i can come here again to read you

There is no doubt that your post was a big help to me. I really enjoyed reading it.

Thank you for providing me with these article examples.

You should write more articles like this, you really helped me and I love the subject.

Thank you for posting such a wonderful article. It helped me a lot and I appreciate the topic.

Post a Comment